Lash Tech's Guide to Tax Write Offs

March 22, 2018 by The Lash Professional.

If you’re a lash artist or running your own lash business, taxes might not be the most glamorous part of your career—but trust me, knowing how to maximize your tax write-offs is so worth it. As a lash artist who reps The Lash Professional, I’ve learned a thing or two about saving money during tax season.

In this guide, I’m breaking down everything you need to know about tax write-offs for lash techs. Whether you’re a solopreneur or growing a full-blown beauty empire, these tips will help you keep more of your hard-earned cash while staying on the IRS’s good side.

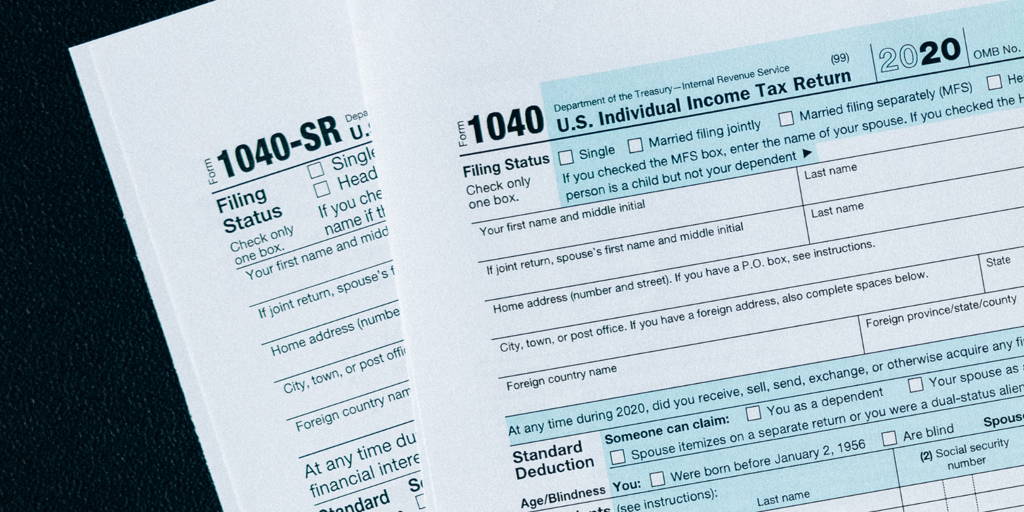

What Are Tax Write-Offs?

Let’s start with the basics: a tax write-off is an expense that you can deduct from your taxable income. For lash techs, this means you can subtract certain business expenses from the money you’ve earned, reducing how much you owe in taxes.

The key is making sure your expenses are ordinary and necessary for your business. If it’s something you use to keep your lash business running smoothly, chances are it’s deductible!

Common Tax Write-Offs for Lash Techs

Here are some common expenses you can write off as a lash artist. Grab a pen (or your notes app) and start keeping track of these throughout the year!

1. Lash Supplies and Products

Everything you use to create those gorgeous lash sets is tax-deductible. This includes:

-Lash trays (classic, volume, hybrid—you name it).

-Adhesives and removers.

-Tweezers, spoolies, and tools.

-Lash lift kits.

If you buy your supplies from The Lash Professional, keep those receipts—they’re gold come tax time!

2. Equipment and Furniture

If you’ve invested in comfy lash beds, ring lights, magnifying glasses, or storage carts, these items are deductible, too. Even your cute salon décor can count if it’s part of your workspace.

3. Rent and Utilities

Do you rent a studio or salon space? The cost of your rent, electricity, and water can all be written off. If you work from home, you may be able to deduct a portion of your rent or mortgage, utilities, and internet.

4. Marketing and Advertising

Your Instagram ads, business cards, website hosting, and any other marketing expenses are 100% deductible.

Pro Tip: If you’ve taken The Lash Professional’s Meta Ads Class for Lash Artists, that’s a write-off, too!

5. Education and Training

Continuing education is key in the beauty industry, and luckily, it’s tax-deductible. Courses like lash styling classes, business training, or certifications are all fair game.

6. Business Software and Apps

If you use booking software, payment apps, or tools like Canva for social media content, you can write off subscription fees.

7. Travel Expenses

If you attend lash conferences, training events, or client appointments that require travel, you can write off:

-Airfare or gas.

-Lodging.

-Meals while traveling for business.

Pro Tips for Tracking Write-Offs

1. Keep Organized Records

Save every receipt and invoice related to your business expenses. Digital tools like QuickBooks or Wave can help you track everything in one place.

2. Separate Business and Personal Finances

If you don’t already have a separate bank account for your lash business, now’s the time to set one up. This makes it so much easier to track your expenses and income.

3. Consult a Tax Professional

Even if you’re super organized, working with a tax pro can help you find write-offs you might have missed. Plus, they’ll make sure you’re following all the rules.

FAQs About Tax Write-Offs for Lash Techs

1. Can I Write Off My Lash Training?

Yes! Any education or certification courses you’ve taken for your business are deductible. That includes online training programs, like those offered by The Lash Professional.

2. What About My Cell Phone Bill?

If you use your phone for business purposes (like booking clients or managing your social media), you can write off a portion of your bill.

3. Can I Deduct Lash Supplies I Bought Last Year?

Unfortunately, no. You can only deduct expenses from the current tax year.

Why Tax Write-Offs Are a Game-Changer

Taking advantage of tax write-offs isn’t just about saving money—it’s about reinvesting in your business. By reducing your taxable income, you can put those extra dollars toward better supplies, advanced training, or even upgrading your salon space.

If you’re serious about growing your lash business, staying on top of your finances is just as important as perfecting your isolation technique.

Why The Lash Professional Has Your Back

At The Lash Professional, we don’t just sell high-quality lash products and training—we’re here to help you succeed in every aspect of your business. From lash supplies to marketing classes, we’re your partner in building a thriving lash career.

Final Thoughts on Lash Tech's Guide to Tax Write-Offs

So, how can you use tax write-offs to your advantage? By keeping track of your expenses, staying organized, and working with a tax pro, you can save money and reinvest in your lash business.

Whether you’re buying lash supplies, upgrading your workspace, or taking a training course, remember that these investments are part of what makes you an amazing lash artist. And the best part? They’re tax-deductible!

Ready to take your lash business to the next level? Check out The Lash Professional’s premium products and online classes today!

Interested in taking your lash business to the next level?